On Friday, the Financial Times pulled Softbank out of the Japanese investment group, the “Nasdaq Whale” whose alternative business began a watchdog rally in tech stocks before a rebellious market correction this week.

Now, with the wind suddenly coming out of inflated prices, investors are immediately trying to understand how activity in the derivatives markets sent Apple, Tesla and large numbers of hot stocks to record highs – and what could happen next.

So what are the options?

Equity options give investors the right to buy or sell a stock in the future where it is currently trading above or below the price.

They serve an important purpose of hedging investment portfolios against losses, but they also have a long history of big gains and losses for analysts.

A stock option – the right to buy stock – is profitable if the share price exceeds the agreed level. A put option – the right to sell stock at a fixed price – can be valuable in the event of a sharp fall in prices.

Buyers of the options will have to pay a small amount for the contract, but not much more than the money that can be made or saved if the underlying shares are removed immediately.

How has the activity of the alternative market deviated from the normal pattern?

Investors with an equity portfolio often prefer to own shares as insurance to protect themselves from large spots in a wide market.

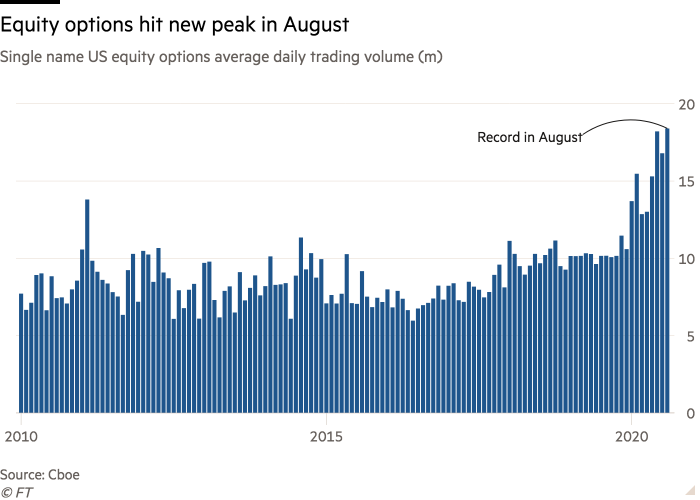

Over the past few months, however, it has come under scrutiny for mega-cap tech stocks and increasing buying on call options – especially Apple and Tesla.

It looked at some of the elders like a conjecture mania. Investors are betting that tech stocks will rise further as the buying options that protect their holdings from those share buying prices have soared. The put-to-call ratio in Apple stock on Monday was the lowest in at least 10 years, according to Bloomberg data; Last month the Tesla ratio set a four-year low.

David Silver, head of equity derivatives at Citidel Securities, said the move is a function of more alternative sellers than alternative buyers, especially among top technologists.

Who is running the alternative activity?

The combination of retail investors and large funds has jumped into the call option bandwagon. A major institution nicknamed “Nasdaq Whale” by traders and now identified as Masaoshi’s son Softbank has had an impact on buyer buying the call and attracted many more players on the ride.

Already large profit-making funds have been happy to reap some of their profits to earn more in their portfolios and aggressively buy calls. Retail investors, such as online platforms such as Robinhood Trading – Commission Free – have also embraced a record number of options trading and chased the name of big technology.

“The apparent growth of small retail investors and the apparent growth of alternative-related businesses. . . This has contributed to the speculative nature of the market in recent weeks, ”said Chris Igo, chief investment officer at AXA Investment Advisors.

What does such a one-sided activity mean for a wider market?

The call buying scale centered on several market abolitions and led traders to see a feedback loop that pushed tech stocks dangerously high.

The alternative market activity is linked to the stock market. Dealers are options. These dealers – including big banks like Goldman Sachs, JPMorgan and Morgan Stanley, and expert market makers like Citidel Securities – call when share prices rise and those options become profitable. The holder of the options has the opportunity to pay.

To avoid this risk, dealers buy the underlying stock, so they also get a share of any share price spike. Their purchase, instead, pushes the underlying stock, creating a self-fulfilling prophecy that helped push Tesla and Apple to all-time highs this week.

On the eve of the sell-off on Thursday, alternative markets were predicting increased volatility in Nasdaq stocks compared to the rest of the stock market, especially with wild oscillations. Typically, such volatility measures are minimized when the market rises. The deviation was a complete warning for equity bulls.

What goes up can come down

View trades became extremely dangerous when the strength of the options trade and reached a tipping point this week. Stocks have come to dominate.

The Nasdaq 100 cut its bottom line in March from a low of about 62 percent compared to its peak of 68 percent as the selling pressure increased on Friday.

Given the scale of alternative activity, the market may take some time to stabilize. This suggests for a higher volatility and further downside of technical stocks but it also helps calm the market as volatile traders take action and the dust settles.

Already, equity investors are likely to cut prices at extremely low interest rates on bonds, and the earnings of large tech companies compared to other industries have been warmed by the recession this year.

The key is that the alternatives will be the main part of the image. “The dynamics of the options market is certainly becoming a bigger part of the equity market,” said Mr. Silver of Citidel. “

Organizer. Zombie aficionado. Wannabe reader. Passionate writer. Twitter lover. Music scholar. Web expert.