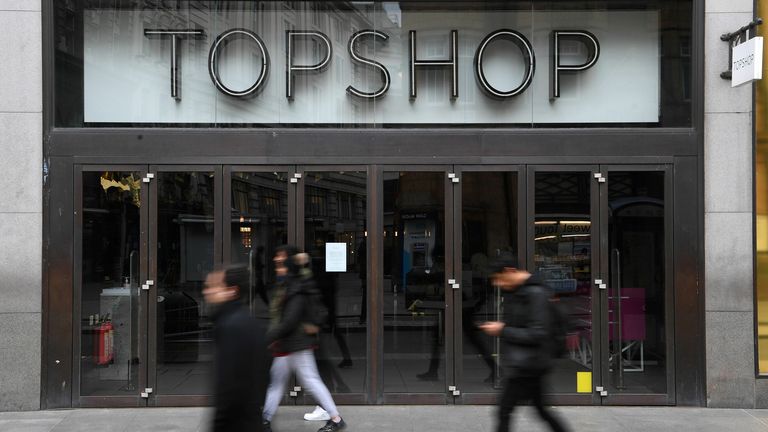

Michael Ashley is giving Sir Philip Green a m 50 million lifeline to submerge the Orchidia Group in one of the biggest beasts of the high street for control of the Topshop Empire.

Sky News has learned that Mr Ashley Fraser’s group plans to make an emergency loan to Arcadia just hours before its board appoints administrators, putting 13,000 jobs at risk.

The proposal would intensify fierce competition between the two, and Mr Ashley adopted a similar strategy before the collapse of other major retailers, including Denhams, in recent years.

Chris Watton, Fraser’s chief financial officer, confirmed the offer on Saturday: “We hope Sir Philip Green and the Arcadia Group will contact us today to discuss how we can support them and help save as many jobs as possible.” “

A source close to Fraser said the proposed refinancing was likely to take the form of a secured loan and was intended to prevent Arcadia – which owns Burton and Dorothy Parkin – from entering the administration.

The proposal raised skepticism from analysts, who said any loan from the Fraser Group or Mr Ashley would require approval of his pension scheme, which would require additional protection from disclosure to the company.

“It sounds like a stunt,” one said.

Mr Ashley told ITV News on Friday that he was interested in buying all the brands in Arcadia.

Sky News reported earlier this month that Arcadia had negotiated an emergency £ 30 million loan with several parties, but the security issue is believed to have played a key role in the inability to finalize a deal.

The collapse of Sir Philip’s retail group of billionaire tycoons since 2002, the most accidents since the start of the coronavirus epidemic, will add Debenhams, Edinburgh Woolen Mill and Keith Kidston to the list of high street inconveniences.

This weekend, it also emerged that the taxpayer could miss a few million pounds from the Arcadia administration due to the potential time of insolvency.

As of Tuesday, the introduction of crown choices in patterns means Harvest Revenue and tariffs leapfrog before unsecured credit payers and payers who bankroll companies against their listings and stocks.

If Arcadia hires administrators on Monday, HMRC will rank it as an unsecured creditor, meaning it will probably be seen as just a small payment of Sir Philip’s millions of pounds in the decade.

This time was marked not as intentional but as a coincidence, and people close to the situation noted that HMRC’s reduced recovery would result in more money than return to Arcadia’s pension scheme and many small business suppliers.

Aracadia declined to comment outside a statement issued Friday, saying: “The forced eviction of our stores for the duration of the COVID-19 epidemic has affected our business.

“As a result, Arcadia boards are working on various crisis options to protect the future of the group’s brands.

“Brands continue to trade and our stores will reopen in England and ROI next week with the lifting of official COVID-19 bans.”

Another statement is expected on Monday.

Mr. Ashley’s recognized interest in lending the latest mining loan to Arcadia comes as he and other high street tycoons take a stand to try to gain control of Topshop and a few brands of Arcadia.

JD Sports Fashion, Bohu Group and Next are all expected to take part in the Topshop, which was valued at ২ 2 billion less than a decade ago but can now fetch around £ 250m.

It is said that Sir Philip is unlikely to bring back any activity of the Arcadia business from the administrators.

Confirmation of the administration will come after a few years of turmoil where Sir Philip’s reputation was tarnished and his fortunes eroded by unrest on highways and, more recently, the coronavirus epidemic.

Earlier this year, Arcadia hired about 13,000 people and announced the retirement of about 500 head office workers.

It has more than 500 standalone sites, most of which are closed due to the second England-wide lockdown, which will end next week.

Most of the employees of this group have received their wages this year under the government fallu scheme by the taxpayers.

The collapse of the organization will capture one of the most spectacular implementations in recent corporate history.

Sir Philip bought the High Street Group in 2002 for 50 5,050 million, and just three years later paid one of the largest dividends ever paid to Lady Christina, the registered owner of Arcadia – £ 1.2 billion.

For years, he was fed up as High Street Colasus, advising David Cameron on public sector waste while he was prime minister.

In 2012, Topshop’s instant holding company sold 25% of its shares to private equity firm Leonard Green & Partners, valued at ্যাশন 2 billion.

Sir Philip later bought it for only 1 1.

The decision to sell department distil chain BHS to Dominic Chapel in 2015 for a dollar, who was recently jailed for tax evasion, sparked an event that cost Sir Philip a lot of fame and fortune.

The BHS broke up just one year after the agreement and infuriated Sir Philip’s responsibilities to the pensioners.

In early 2013, Sir Philip struck a deal with pension watchdogs to pay more than 300 million for the BHS project, setting the tone for negotiations two years after Arcadia’s retirement fund.

Last year, Tichun found little approval for a company’s voluntary arrangement at Arcadia, but they were forced to pledge a package of assets worth more than 400 million in the company’s pension scheme.

Sir Philip’s tragic time was not limited to the pursuit of his business interests.

He was caught in the storm because of his behavior towards Arcadia employees and his use of disclosure-non-contracts to prevent ex-employees from discussing separation packages.

Organizer. Zombie aficionado. Wannabe reader. Passionate writer. Twitter lover. Music scholar. Web expert.