Good morning, and welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

Global markets are subdued this morning, after Japan became the latest country to suffer a historic economic slump due to the Covid-19 pandemic.

And with factory output weaker than expected in June, the recovery in the world’s third-largest economy could be slower than hoped.

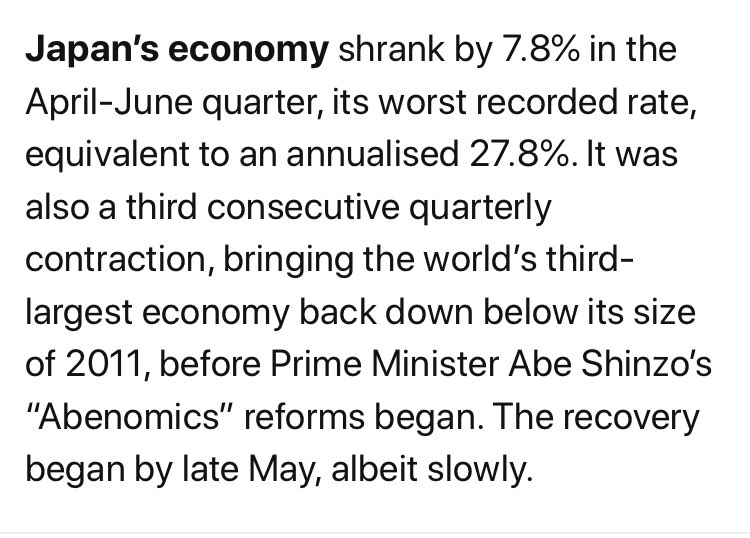

Japanese GDP shrank by 7.8% during the April-June quarter, as its pandemic lockdown hit growth. That wipes out all the growth achieved since 2011:

Wandile Sihlobo

(@WandileSihlobo)some snippets from @TheEconomist on Japan’s 2nd-quarter GDP data. pic.twitter.com/HRWMLWTJ3R

One Cabinet Office official told the Japan Times that it’s the worst slump since modern records began in 1955! It’s certainly the worst since the current dataset began in 1980.

LiveSquawk

(@LiveSquawk)Japan Q2 GDP Posts Biggest Contraction Since Comparable Data Became Available In 1980 – Govt

The GDP report painted a now-familiar picture — household spending slumped as shops shut and workers stayed home, while manufacturing was hammered by the plunge in global trade.

As my colleague Alison Rourke reports:

Private consumption, which accounts for more than half of Japan’s economy, fell 8.2% for the quarter, bigger than analysts’ forecast of a 7.1% drop. Capital expenditure declined 1.5% in the second quarter, less than a median market forecast for a 4.2% fall.

External demand, or exports minus imports, shaved 3.0% off GDP, as the pandemic dampened global demand, the data showed.

Guardian US

(@GuardianUS)Global report: Japan hit by biggest GDP fall in 40 years, Australia suffers deadliest day https://t.co/wptTyYc2Rn

Economists expected a big slump in GDP, of course. They also expected a bounceback as the lockdown eased….. but industrial production only rose by 1.9% in June — below the 2.7% jump expected, after plunging by 8.9% in May.

This hit sentiment in Tokyo, where the Nikkei has fallen by 192 points or 0.8% to 23,096.

European markets are likely to be subdued today too, after sliding on Friday when the UK imposed new quarantine restrictions on France.

IGSquawk

(@IGSquawk)European Opening Calls:#FTSE 6094 +0.06%#DAX 12893 -0.06%#CAC 4968 +0.09%#AEX 561 -0.06%#MIB 20045 +0.09%#IBEX 7173 +0.26%#OMX 1753 -0.04%#STOXX 3305 +0.01%#IGOpeningCall

Michael Hewson of CMC Markets detects “increasing nervousness” in the markets that economies are reaching the limits of what they can do, without increasing the risk of a new surge in Covid cases.

Asia markets have started the week on a mixed note with the latest Japanese Q2 GDP numbers showing that the world’s third biggest economy contracted by -7.8%, with private consumption sliding -8.2%, both by more than expected. In a development that is even more worrying is that industrial production in June only recovered a modest 1.9% significantly below expectations of 2.7%, and pointing to a weak recovery towards the end of Q2, as we look towards Q3.

As such equity markets here in Europe also look set to open on a mixed note with no clear sense of direction.

We’ll hear from Germany’s Bundesbank this morning – how does it see the recovery playing out? Plus we get new industrial production and housing data from America, which may show how the US economy is faring as the election race hots up.

The agenda

- 11am BST: German Bundesbank’s monthly report

- 1.30pm BST: Empire State survey of manufacturing in New York state

- 3pm BST: NAHB index of US housing market

Organizer. Zombie aficionado. Wannabe reader. Passionate writer. Twitter lover. Music scholar. Web expert.